They have agreed to open-ended easing until such time as either the unemployment rate approaches full employment, or the inflation expectations (significantly) breach the the two percent ceiling.

For reasons previously discussed, the inflation rate will not rise until the economy approaches full employment, as inflation happens when the production of money (really money*velocity = ngdp) outstrips the production of goods, but when there are idle resources monetary stimulus puts them to work and we get more goods in line with the money spent, so no inflation.

I also want to rebuke those Keynesians who believe that monetary policy works through concrete channels. Clearly there are still some of them on the FOMC board, because the FOMC said:

Quote

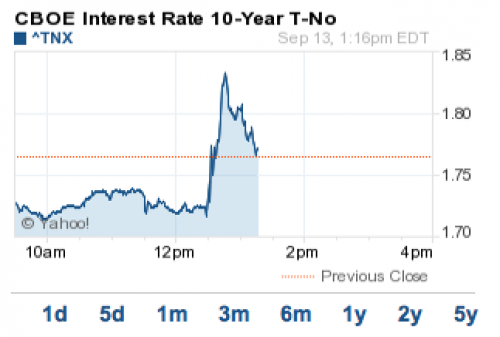

What actually happened:

Interest rates rose because expectations of future economic activity rose, and who wants to buy bonds at these prices if the economy is going to be roaring in ten years time.

Successful monetary policy will increase interest rates, because it will increase future expected GDP.

Monetary policy policy works through controlling the price of money (=the size of NGDP). Since the price is wrong, and this is preventing economic activity through sticky wages, moves to correct it are positive for the economy. In response, the stock markets have gone crazy. In particulars, mining companies, and broad etf commodities are up, and still rising strongly in European trading, because expectations of future economic activity are up. Us treasury yields are up. Even Uk treasure yields are up. Rebalancing into risk assets and out of defensive assets is continuing apace. Miners are up, banks are up, utilities are down.

Mark it in your history books. Today the fed saw the light, and so the US will now exit recession, banking condititions will improve, and within one to two years, barring European catastrophe, the US will be in the clear.

Now, if only the ECB would follow suit.......

Help

Help